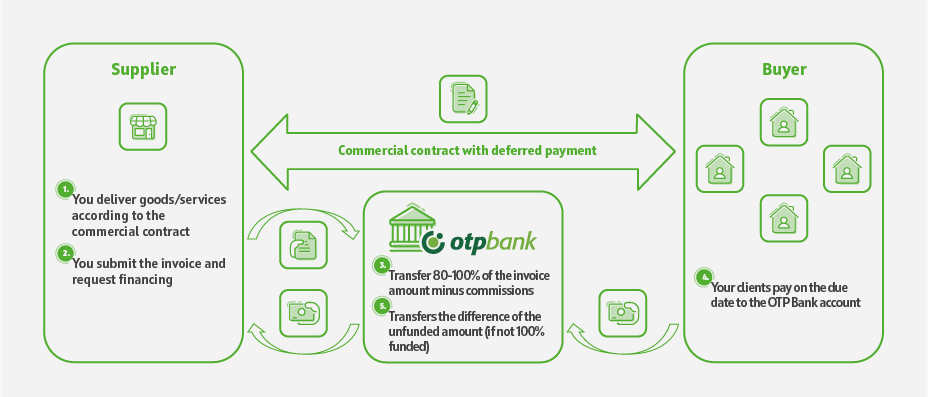

Local factoring is a financial solution that allows you to collect money for goods delivered or services provided more quickly, without waiting for payment from your customer on the due date. Basically, you assign the receivables resulting from invoices issued to domestic customers to the bank and collect payment immediately, which allows you to finance your business, grow, and strengthen relationships with partners.

Why choose Factoring from OTP Bank?

- Immediate liquidity: you receive between 80% and 100% of the invoice value in your account after the invoice is issued.

- Stable cash flow: you no longer have to wait for payment on the due date to honor your payments to suppliers or employees.

- No collateral required.

- Relationship development: you can offer your customers longer payment terms, which can improve your business relationship and create a competitive advantage.

- Digital flow through e-Factoring.

What are the conditions?

1. The business relationship is based on a commercial contract with deferred payment and regular deliveries

2. Payment term: up to 120 days

3. Invoices are not past due

4. There are no affiliate relationships with customers

Types of local factoring

- Non-recourse: The factor assumes the risk of non-payment by the buyer. If the buyer does not pay on the due date, the factor will not request payment from the supplier (except in the case of a commercial dispute). This is only possible for buyers for whom the factor has approved a factoring limit based on an assessment of the buyer's financial standing.

- Non-recourse: The factor assumes the risk of non-payment by the buyer. If the buyer does not pay on the due date, the factor will not request payment from the supplier (except in the case of a commercial dispute). This is only possible for buyers for whom the factor has approved a factoring limit based on an assessment of the buyer's financial standing.

How does factoring work?